Mergers and acquisitions (M&A) are often seen as high-stakes gambles in the business world. While some fail spectacularly, others succeed beyond expectations, creating value, innovation, and market dominance. In this post, we will explore mergers and acquisitions examples that have stood the test of time, examining why they were successful and how they transformed the companies involved.

The 10 Best Examples of Mergers and Acquisitions

While many M&A stories make headlines because they didn’t work out, these mergers and acquisitions examples prove that the opposite can be true and provide a blueprint for success for any organization.

1. The Walt Disney Company and Pixar (2006)

Background: By the early 2000s, Pixar had already become a household name with its string of successful animated films like Toy Story, Finding Nemo, and The Incredibles. However, despite their success, Pixar’s relationship with Disney, its distribution partner, had become strained. Disney, seeking to secure its future in animation, decided to acquire Pixar for $7.4 billion in an all-stock deal.

Why It Was Successful: This acquisition was a match made in heaven. Disney’s acquisition of Pixar rejuvenated its animation division and allowed it to maintain its legacy as a leader in animated films. The success of the merger was largely due to Disney’s decision to allow Pixar to operate independently, maintaining its unique creative culture while providing access to Disney’s vast resources. This merger led to the creation of blockbuster hits like Toy Story 3, Frozen, and Moana, solidifying Disney’s dominance in the animation industry.

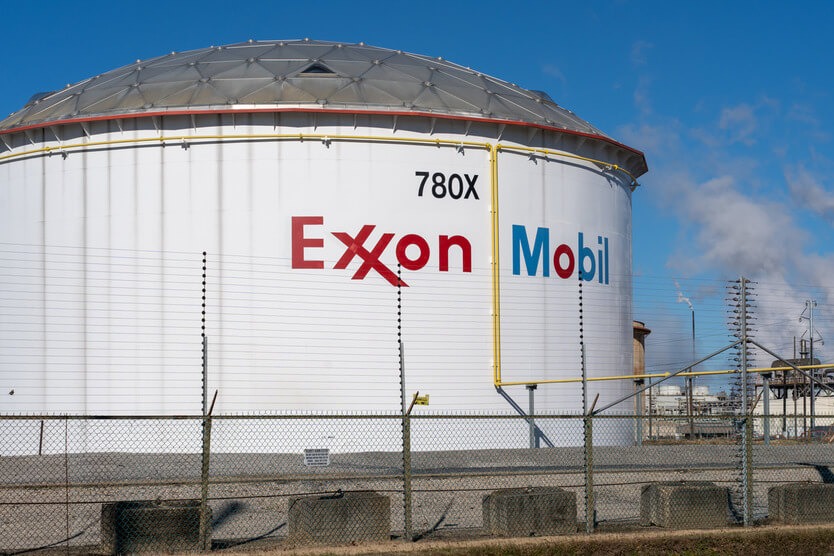

2. Exxon and Mobil (1999)

Background: The merger between Exxon and Mobil, two of the largest oil companies in the world, was valued at $81 billion and was one of the biggest mergers in history. This deal came when the oil industry faced low crude prices, and companies were looking for ways to cut costs and remain competitive.

Why It Was Successful: The ExxonMobil merger created the largest publicly traded oil and gas company in the world. The success of this mergers and acquisitions example can be attributed to the synergies realized in operations, cost efficiencies, and enhanced global reach. The company was able to streamline its operations, reduce redundancies, and invest in new technologies. Today, ExxonMobil remains one of the most powerful entities in the energy sector, with a significant presence in both upstream and downstream operations.

3. Facebook and Instagram (2012)

Background: When Facebook acquired Instagram for $1 billion in 2012, many questioned the wisdom of paying such a high price for a company with only 13 employees and no revenue model. However, Facebook saw the potential in Instagram’s rapidly growing user base and the opportunity to dominate the mobile photo-sharing space.

Why It Was Successful: The acquisition of Instagram is considered one of the best tech deals of the decade. By allowing Instagram to operate independently while leveraging Facebook’s resources and advertising platform, the social media giant was able to significantly increase its user base, market penetration, and revenue. Instagram now boasts over 1 billion active users and generates billions in advertising revenue, making it one of Facebook’s most valuable assets. This acquisition not only solidified Facebook’s position in the social media landscape but also set the stage for its dominance in mobile advertising.

4. JPMorgan Chase & Co. and Bank One Corporation (2004)

Background: The merger between JPMorgan Chase & Co. and Bank One Corporation was valued at $58 billion and created one of the largest financial institutions in the United States. The deal was driven by the need to diversify revenue streams and improve competitiveness in the rapidly evolving financial services industry.

Why It Was Successful: The success of this mergers and acquisitions example can be attributed to the complementary strengths of the two companies. JPMorgan Chase brought a strong investment banking and asset management business, while Bank One had a robust retail banking network. The merger allowed the combined entity to offer its customers a broader range of services, reduce costs through synergies, and expand its market share. Today, JPMorgan Chase & Co. is one of the world’s leading financial institutions, with a strong presence in both retail and investment banking.

5. Google and Android (2005)

Background: In 2005, Google acquired a small startup called Android Inc. for an undisclosed amount. At the time, Android was a relatively unknown company developing software for mobile devices. However, Google recognized Android’s potential to challenge the dominance of operating systems like Apple’s iOS.

Why It Was Successful: The acquisition of Android has proven to be one of Google’s most successful strategic moves. By developing and promoting Android as an open-source platform, Google was able to attract a large number of device manufacturers and developers. Today, Android is the world’s most widely used mobile operating system, powering billions of devices worldwide. This mergers and acquisitions example enabled Google to establish a strong foothold in the mobile ecosystem and build a lucrative business around mobile search and advertising.

6. Disney and 21st Century Fox (2019)

Background: Disney’s $71.3 billion acquisition of 21st Century Fox was a landmark deal that reshaped the entertainment industry. The acquisition included Fox’s film and television studios, cable networks, and international assets. This deal was driven by Disney’s desire to expand its content library, enhance its direct-to-consumer offerings, and compete with streaming giants like Netflix.

Why It Was Successful: This successful mergers and acquisitions example lies in Disney’s ability to leverage Fox’s vast content library, including franchises like X-Men, Avatar, and The Simpsons, to strengthen its position in the entertainment industry. The acquisition also provided Disney with the majority stake in Hulu, enhancing its streaming capabilities. With the launch of Disney+ and the integration of Fox’s content, Disney has become a dominant player in the streaming wars, attracting millions of subscribers and generating significant revenue.

7. AT&T and Time Warner (2018)

Background: The $85.4 billion merger between AT&T and Time Warner was a strategic move to combine content creation with content distribution. By acquiring Time Warner, AT&T gained access to a vast portfolio of media assets, including HBO, Warner Bros., and Turner Broadcasting.

Why It Was Successful: The success of this merger can be attributed to the synergies between AT&T’s distribution capabilities and Time Warner’s premium content. The merger allowed AT&T to offer a vertically integrated entertainment experience, from content creation to distribution. The launch of HBO Max, which combines Time Warner’s content with AT&T’s distribution network, has been a key factor in the company’s growth in the streaming space. This merger has positioned AT&T as a major player in the media and telecommunications industries, with the ability to compete with other tech and entertainment giants.

8. Amazon and Whole Foods (2017)

Background: Amazon’s $13.7 billion acquisition of Whole Foods marked its entry into the brick-and-mortar retail space. The deal was seen as a way for Amazon to expand its presence in the grocery industry and enhance its distribution network for fresh food products.

Why It Was Successful: The success of this acquisition lies in Amazon’s ability to integrate Whole Foods into its broader ecosystem. By leveraging its technological expertise and logistics network, Amazon has been able to enhance Whole Foods’ operations, offer competitive pricing, and expand its reach through online delivery services like Amazon Fresh. The acquisition has allowed Amazon to disrupt the grocery industry, attract a new customer base, and strengthen its position as a retail giant.

9. Salesforce and Slack (2021)

Background: Salesforce’s $27.7 billion acquisition of Slack was a strategic move to enhance its position in the enterprise software market. With the rise of remote work and digital collaboration, Salesforce recognized the growing importance of communication platforms like Slack in the workplace.

Why It Was Successful: The acquisition of Slack has allowed Salesforce to offer a more comprehensive suite of business communication and collaboration tools. By integrating Slack with its existing products, Salesforce has been able to provide a seamless experience for its customers, enabling them to communicate, collaborate, and manage their workflows more effectively. This acquisition has strengthened Salesforce’s competitive edge in the enterprise software market and positioned it as a leader in the digital transformation space.

10. Glaxo Wellcome and SmithKline Beecham (2000)

Background: The $75.7 billion merger between Glaxo Wellcome and SmithKline Beecham created one of the world’s largest pharmaceutical companies, GlaxoSmithKline (GSK). The deal was driven by the need to increase R&D capabilities, enhance global reach, and achieve cost efficiencies.

Why It Was Successful: The success of this merger can be attributed to the combined company’s ability to leverage its expanded R&D capabilities to develop new and innovative drugs. GSK has become a leader in several therapeutic areas, including vaccines, respiratory, and HIV/AIDS treatments. The merger also allowed the company to achieve significant cost savings and operational efficiencies, strengthening its position in the highly competitive pharmaceutical industry.

Achieving the Next M&A Success Story

The best mergers and acquisitions examples are those that create value, drive innovation, and position companies for long-term success. While not every deal achieves these goals, the examples highlighted in this post demonstrate how strategic integration planning, cultural alignment, and the right assets can lead to transformative results. From Disney’s acquisition of Pixar to Google’s acquisition of Android to Amazon’s acquisition of Whole Foods, these deals have reshaped industries, created market leaders, and delivered significant returns for shareholders.

As we continue to see new M&A activity across various industries, the lessons learned from these successful deals can provide valuable insights for companies looking to navigate the complexities of mergers and acquisitions. Whether you’re a business leader, an investor, or any corporate strategy stakeholder, understanding what makes an M&A deal successful is key to appreciating the impact these transactions can have on the global business landscape.

Looking to optimize your due diligence process?

Get a head start with our exclusive white paper, “The Silent Threats in M&A Due Diligence,” where you’ll find actionable insights to implement now to avoid the common pitfalls of due diligence.

Download Now